The 7-Second Trick For Paul B Insurance

Table of ContentsThe Definitive Guide to Paul B InsuranceAn Unbiased View of Paul B InsuranceThe Single Strategy To Use For Paul B InsuranceExcitement About Paul B InsuranceAn Unbiased View of Paul B InsuranceThe Only Guide to Paul B InsurancePaul B Insurance Things To Know Before You Buy

They can be appealing since they have lower premiums. Commonly, patients with these kinds of plans do not recognize that the strategy they have actually acquired has even more restrictions than traditional health and wellness insurance policy, which their strategy will not actually cover the services they need. Individuals with this kind of protection can still be seen at UCHealth-affiliated centers.Limited Benefits as well as Practitioner/Ancillary Only plans are not constantly easy to recognize as well as the cards these strategies provide to their participants are typically confusing. Limited Benefits Strategies pass many names, including, yet not restricted to: limited advantages strategies, practitioner-only strategy, physician-only plan, and so on. Restricted Benefits Plans additionally commonly make use of a method called "unilateral pricing," which indicates the strategy attempts to dictate to a health center or physician just how much they must be spent for offering wellness solutions to their participants, although the strategy does not have a contract with the medical facility or medical professional.

Additionally, Minimal Benefits Plans may inform their members that they can most likely to any kind of health center they desire or make use of any type of doctor they choose, yet that does not suggest that the strategy is in-network with UCHealth. Health Shares are offer restricted coverage and also compensation for minimal services. Simply put, they pay extremely little for extremely few kinds of services.

Our Paul B Insurance Diaries

Wellness Shares may seem like wellness insurance, they are not. Often, individuals with these sorts of plans do not understand that the plan they have actually purchased is not medical insurance, and that their plan won't actually cover the services they need. Individuals with this kind of "coverage" can still be seen at UCHealth-affiliated facilities, however we do not get previous authorizations or expense them on part of patients.

If the client intends to look for reimbursement from their Health and wellness Share, they will certainly require to collaborate with the plan straight. If people need a detailed declaration of their services, otherwise referred to as an Itemized Statement, clients can send an Itemized Declaration request online or contact us. Wellness Shares are not always simple to recognize, and the cards these strategies offer to their participants are often complex.

Sometimes the plan cards do explicitly state that the strategy is not medical insurance. Furthermore, Health Shares may tell their members that they can go to any hospital they want or utilize any type of medical professional they pick, yet that does not suggest that the strategy is in-network or accepted by us.

The Greatest Guide To Paul B Insurance

Some insurance coverage plans need members to utilize particular laboratories, or to acquire a reference or consent before particular types of treatment.

Cathie Ericson Sep 27, 2020 When selecting a medical insurance plan, it's crucial to understand just how much you might have to pay of pocket every year.

You'll get discount rates for various other points also like eyewear, orthodontics as well as healthy and balanced consuming programs. You can Extra resources also save on infant items as well as medical spa solutions. You'll likewise have protection via Help America, simply in instance something takes place while you're taking a trip away from house.

Paul B Insurance for Dummies

When you're picking a health insurance coverage plan, it's vital to know it will fit your requirements. If you need help, use the Plan for Me device.

The web links below clarify the his comment is here savings account kinds. You likely have numerous more inquiries when you're picking a new insurance policy plan.

The Best Strategy To Use For Paul B Insurance

You'll need to make use of medical professionals and also medical facilities that are in the plan's network. Out-of-network services are covered just for urgent care and emergencies.

The Basic Principles Of Paul B Insurance

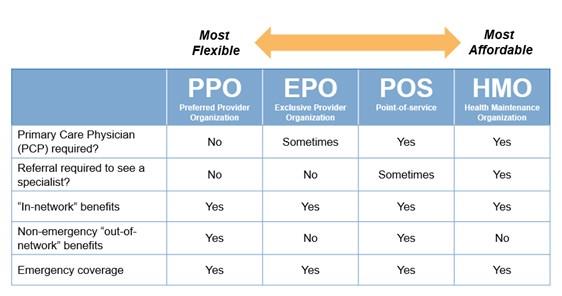

With a PPO plan, you are not called for to choose (or mark) a PCP. But if you do, they will certainly act as your personal physician for all routine and precautionary health and wellness treatment solutions. You will save money utilizing an in-network vs. out-of-network PCP. PPO plans offer a few of the biggest adaptability of all health insurance plan kinds.

You normally have a minimal quantity of time to choose the very best medical insurance plan for your household, however hurrying as well as choosing the wrong coverage can be costly. Here's a start-to-finish guide to help you find economical health insurance, whether it's through a state or government industry or with an employer.

More About Paul B Insurance

If your company offers helpful resources health insurance, you will not require to utilize the government insurance exchanges or marketplaces, unless you wish to seek an alternate plan. Strategies in the marketplace are likely to set you back more than strategies offered by companies. This is because a lot of employers pay a section of workers' insurance costs.

Nevertheless, by restricting your options to companies they've acquired with, HMOs do often tend to be the most affordable sort of health insurance plan. An advantage of HMO and POS strategies is that there's one key physician handling your overall clinical treatment, which can result in better experience with your requirements and connection of medical documents.